Third Quarter, 2022

Click here for a printable version of the Investment Update.

Financial markets continued to deliver wrenching results in the third quarter, as the Federal Reserve continued to raise short-term interest rates sharply to quell persistent high inflation. The S&P 500 returned -4.9% in the quarter for a -23.9% return year-to-date. The Barclay’s U.S. Aggregate Bond Index returned -4.8% for the quarter for a -14.6% return year-to-date.

Stocks and bonds rarely decline together. From 1976 through 2021, there were only four instances when U.S. stocks and bonds both delivered negative returns for two consecutive quarters. In 2022, for the first time in at least 45 years, both major asset classes delivered negative returns for three consecutive quarters.

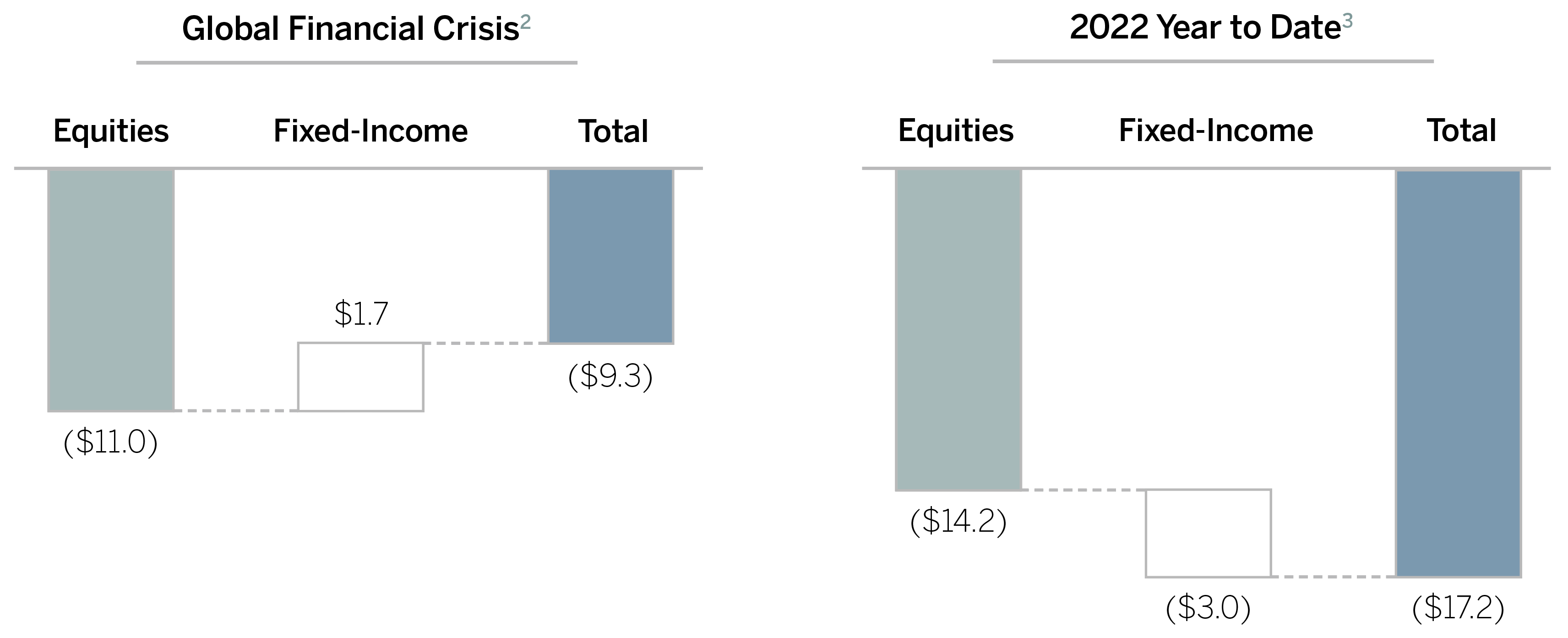

The decline in both stocks and bonds this year has resulted in losses greater than those experienced during the Global Financial Crisis (GFC) of 2008-09. During the GFC, investors endured over $9 trillion of capital destruction in U.S. financial markets, with deep losses in equities and mortgage bonds partly offset by a rally in government bonds. This year capital destruction has exceeded $17 trillion.

Drawdown in U.S. Equity and Fixed-Income Market Capitalization1

($Trillions)

(1) Measured using Bloomberg U.S. Exchange Market Capitalization Index for equities and U.S. Aggregate Index for fixed-income.

(2) October 9, 2007 – March 9, 2009

(3) December 31, 2021 – September 30, 2022

Source: Gavekal, Kevin Muir, Bloomberg

Two Transitions at Once

Financial markets are grappling with two significant transitions, one obvious, the other more subtle but quite powerful.

The first, more obvious transition, is from a time of massive liquidity injections, which the Federal Reserve and other central banks provided to support the global economy during the pandemic, to a time of more normal liquidity conditions. Many investors were stunned by the massive rally in the equity and fixed-income markets during the pandemic, when global economic activity ground to a near halt. The gains in financial markets were largely due to unprecedented fiscal and monetary stimulus at a time when money had nowhere else to go. This largesse also led to short-term inflation, as demand soared for physical goods, while factory and port closures impeded supplies.

Now, central banks are withdrawing much of that excess liquidity to quell inflation, and financial markets are responding accordingly. Despite this year’s decline, the S&P 500 closed the third quarter at the same level it was at during the fourth quarter of 2020 and above its pre-pandemic high.

The second transition is less sudden but is likely to have more profound long-term investment implications. After 40 years of nearly continuous disinflationary tailwinds that drove inflation and bond yields down to extremely low levels, we think the environment is reverting to more normal, cyclical inflation with associated higher interest rates and bond yields.

The End of Disinflationary Tailwinds is an important paradigm shift for investors. Decades of declining yields discouraged investors from owning bonds and pushed them toward riskier asset classes to try to earn “acceptable” returns. With the yield on the 10-year U.S. Treasury bond falling below 2.5% in March 2019 and then plunging to 0.5% after the pandemic hit, many investors adopted a “TINA” mindset – “There Is No Alternative” to equities.

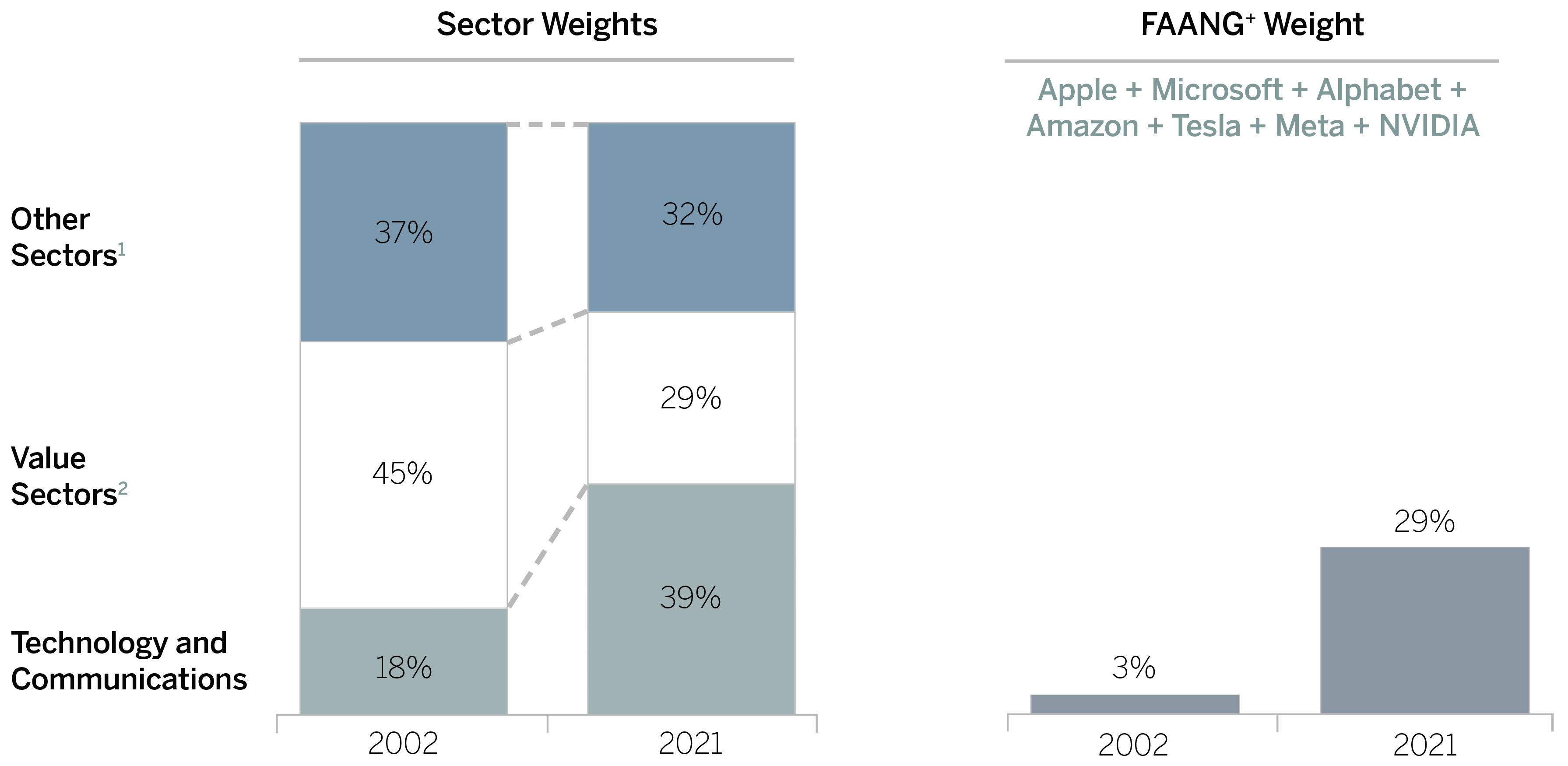

Declining rates also made equities – particularly longer-duration Growth stocks – more attractive in their own right, by increasing the expected value of their future earnings.(1) Technology and communications stocks benefited most from this phenomenon, growing to represent 39% of the total market capitalization of the S&P 500 at the end of 2021. At the same time, the combined weight of six classic value sectors – Financials, Industrials, Energy, Materials, Real Estate and Utilities – shrank to just 29% of the index. Meanwhile, the combined weight of just seven stocks (Apple, Microsoft, Alphabet(2), Amazon, Tesla, Meta(3) and NVIDIA) grew from 3% in 2002 to 29% last year.

(1) For a more in-depth description of this phenomenon, please see the discussion of duration sensitivity in our September 20, 2022, Virtual Investments Symposium, by clicking here. (2) Parent company of Google. (3) Parent company of Facebook.

Sector and Company Concentration in the S&P 500

(1) Discretionary, Staples, Healthcare

(2) Financials, Industrials, Energy, Materials, Utilities, Real Estate

Source: FactSet, S&P 500, Chevy Chase Trust analysis. All data as of June 30, 2002, and December 31, 2021.

No Time to Be Passive

Knowingly or unknowingly, at the end of 2021, investors in passive S&P 500 index funds or ETFs were allocating about 39% of every dollar to the high-growth technology and communications sectors and 29% of every dollar to seven stocks that were equal in weight to the six classic Value sectors combined. Given these circumstances, buying the Index meant taking a high-risk, concentrated position in yesterday’s winners.

We still own some of these stocks for clients, but over the years we have reduced our positions in them. Recently, we have been selling into strength when we can, while paying attention to taxes. While it may be tempting to invest new money in the sectors and stocks that have outperformed over the last 20 years, we think it’s not wise for two reasons.

First, even after the drop in long-duration assets this year, massive amounts of capital are still invested in them. Mathematically, the more money is invested in an asset class, sector or security, the harder it is to earn a return on it. And these long-duration assets no longer enjoy a tailwind from falling interest rates.

Second, while Apple, Microsoft, Alphabet, Amazon, Tesla, Meta and NVIDIA are innovative companies that have delivered terrific sales and earnings growth, they can’t grow as rapidly forever. At some point, they will saturate their markets. Great innovations are often supplanted by newer and better ones, and competitors often take share with a better product or a lower price tag. The first Wang computer of 1972 was great in its time, but the IBM PC eventually displaced it. And IBM, once considered invincible, left the PC market long ago.

New Leaders Will Emerge

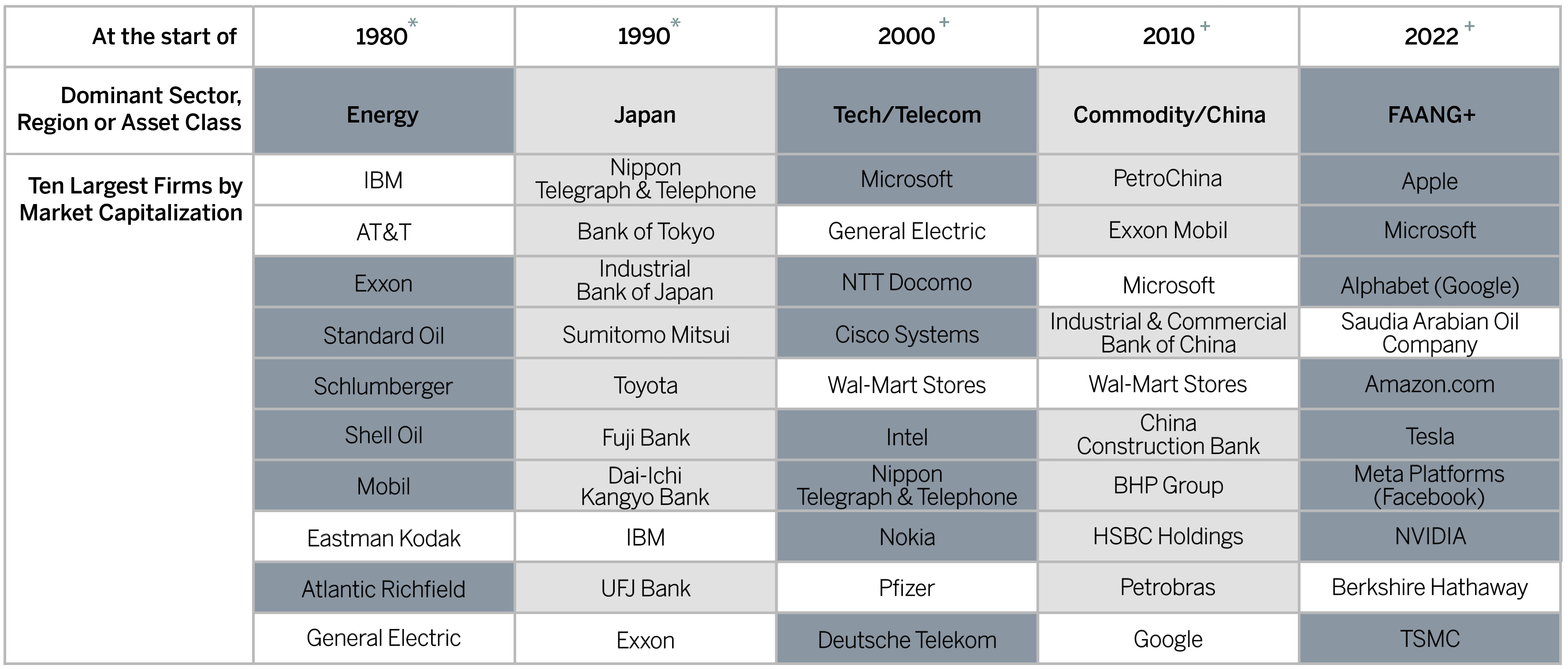

Equity markets have a long history of falling in love with certain groups of companies and projecting their past success into the future – often wrongly. In 1980, amid a global oil crisis, seven of the ten largest-cap stocks were oil companies. In 1990, eight of the ten largest stocks were Japanese. In 2000, seven of the ten were tech or telecom firms, while in 2010, amid China’s manufacturing rise and construction boom, seven were commodity related. Recently, eight have been Internet and tech related.

We think it’s reasonable to expect that few of the world’s largest stocks today will be on the top ten list a few years hence. But the stocks that attain that lofty position for the first time are likely to be among the best investments in the decade to come.

Stock Market Leadership Changes: Top Ten Companies Globally by Market Capitalization

Source: *Gavekal Research, +Bloomberg. Data as of January 1st of the year indicated.

Since 1926, the best-performing 4% of U.S. listed stocks accounted for the net gain of the entire U.S. stock market versus 1-month Treasury bills. Some cite this data to argue that investors should not pick stocks and should just passively own broad market indices, such as the S&P 500. We believe instead that it shows the importance of forward-looking active equity management, focused on selecting stocks with exceptional return potential. Our Thematic investment process is designed to do just that, by identifying changes that will lead to sustainable shifts in market dynamics and competitive advantages for companies in a wide range of industries.

Recent Thematic Development: Advent of Molecular MedicineOur Thematic Equity Portfolios are invested today in six themes. In the midst of a turbulent year in the financial markets, we have seen important developments in many of the industries, technologies and operating companies in which we invest. These have strengthened our conviction in our themes. Recent advances in molecular medicine are a case in point. In early October, Illumina, the leading provider of genomic sequencing equipment, unveiled a new product line that reduces the cost of sequencing a genome by almost two-thirds and the time by roughly half. The company also made the machines easier to use and more efficient. In the past, similar step-change improvements spurred large increases in demand. We expect the same to occur with this new product introduction. In many respects, the genomic sequencing industry is evolving like personal computing. As the cost of computing declined and PCs became easier to use, more applications were developed, which led to even higher demand and usage, and even more applications. A similar “virtuous cycle of demand” is unfolding in genomic sequencing. As costs decline and sequencers become easier to use, more clinicians are prescribing genetic tests to detect specific diseases earlier and treat them more effectively. And as usage of genetic tests and treatments increases, more companies are bringing such products to market. Cell and gene therapies are now being developed at record speeds. More than 2,000 clinical trials are underway globally. Scientists at the Centre for Biomedical Innovation expect 40 to 50 new gene therapies to be approved for clinical use by 2030, compared to the trickle today. We expect Illumina’s latest announcement to accelerate the pace of innovation in molecular medicine. |

Conclusion

The S&P 500 has returned roughly 9.5% a year since the late 1920s, with zigs and zags along the way. After particularly steep increases, like the one from 2010 through 2021, U.S. equities often drop or move sideways for several years. We think the market may now be in one of these consolidation periods, and that broad equity market returns are likely to be below average for the next few years.

When the stock market no longer lifts all boats, investors need skilled, active management to sail into the wind in pursuit of attractive returns. As Thematic investors, this is what we do best.