Globalization: Evolving, Not Ending

A Post-Pandemic Assessment of Globalized Production

Click here for a printable version of Globalization: Evolving, Not Ending.

January 20, 2023 – During the early months of the Covid pandemic, international trade slowed sharply. Goods as simple as medical masks and as complex as advanced semiconductors became impossible to find, speeding the disease’s spread and amplifying its dire economic consequences. The pandemic tattered the web of intricate supply chains woven over the past 30 years, exposing the fragility of a globalized economy that depends upon them.

Many pundits now argue that the great wave of globalization that began more than 30 years ago is ending. They contend that both potential natural disasters and developing geopolitical tensions make it too risky to rely on global trade and production, so governments will require local production of many goods in the name of national security and companies will seek to improve resiliency in their supply chains by bringing production back home.

We disagree. Our research suggests that global production and trade are unlikely to shrink dramatically. Yes, governments are requiring more domestic production of critical goods and their components. But the world needs trade, because energy, food, and other critical or desirable goods can’t be produced everywhere, and many goods that can be produced in many places are most economically produced in just a few.

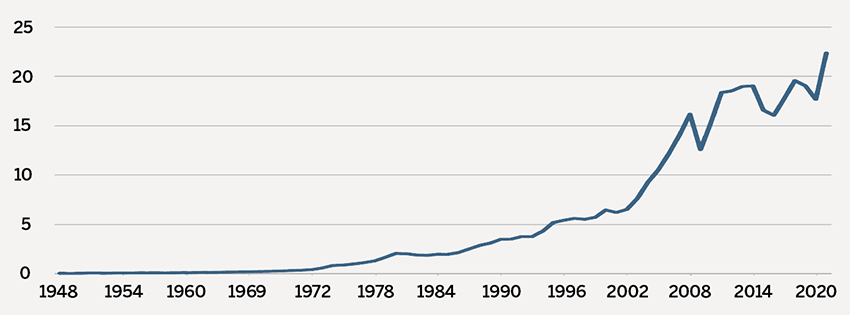

Already the dollar value of global trade has bounced back sharply from its pandemic-related drop to set an all-time high of over $22 trillion (Exhibit 1). Even if half the recent increase was due to inventory rebuilding, global trade would still be setting new records.

Exhibit 1: Global Value of Trade in Goods (1948 – 2021), Trillions

Source: UN Conference on Trade and Development

Predictions that production will simply “come home” are just too sweeping and vague. They ignore the myriad factors that drive production decisions, such as proximity to major markets, tax rates, regulatory burdens, labor costs, access to commodities and components, proximity to partners and shipping costs. As with many aspects of business, the devil is in the details. While change will come, it is likely to occur gradually.

China’s Role

For the most part, when pundits predict that production will come home, they are talking about moving manufacturing from China to the U.S. or other developed countries. China became the world’s factory for reasons that evolved over the past two decades. While some of those reasons are indeed reversing, many remain compelling.

Cost Advantages in Labor and Energy

When China joined the World Trade Organization in 2001, it had two key advantages: cheap labor and cheap energy. China had a population greater than 1.2 billion and an annual GDP per capita below $1,000 a year. Chinese leaders were eager to create jobs that would improve living standards. At the time, China also had abundant low-cost coal and few environmental restrictions on burning it.

Infrastructure Investment

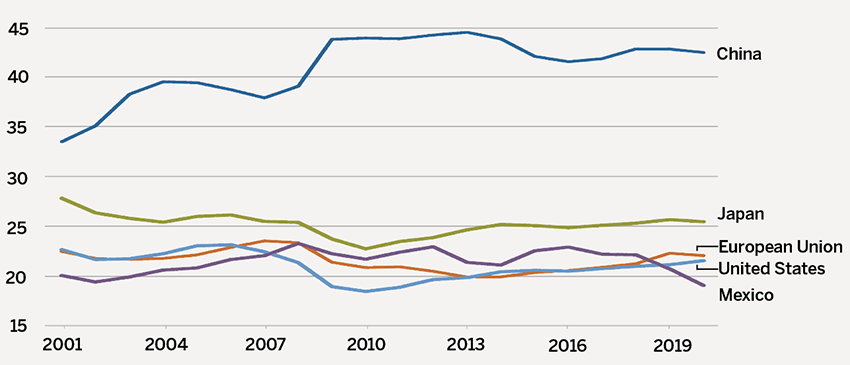

China welcomed global firms, wooing them with promises of massive infrastructure investments. They honored these commitments quickly by building roads, rails, ports and factories as good, if not better, than other countries. For nearly two decades, China’s gross fixed capital formation as a percent of GDP was far higher than most trading partners (Exhibit 2).

Exhibit 2: Gross Fixed Capital Formation as a Percent of GDP

Source: The World Bank

China’s massive fixed-asset investments made it easy for firms to move supplies around the country and to its modernized coastal ports. Between 2001 and 2020, export volumes increased eight-fold. China is now the world’s largest exporter, with cargo volumes only 2% smaller than the total for the entire developed world.

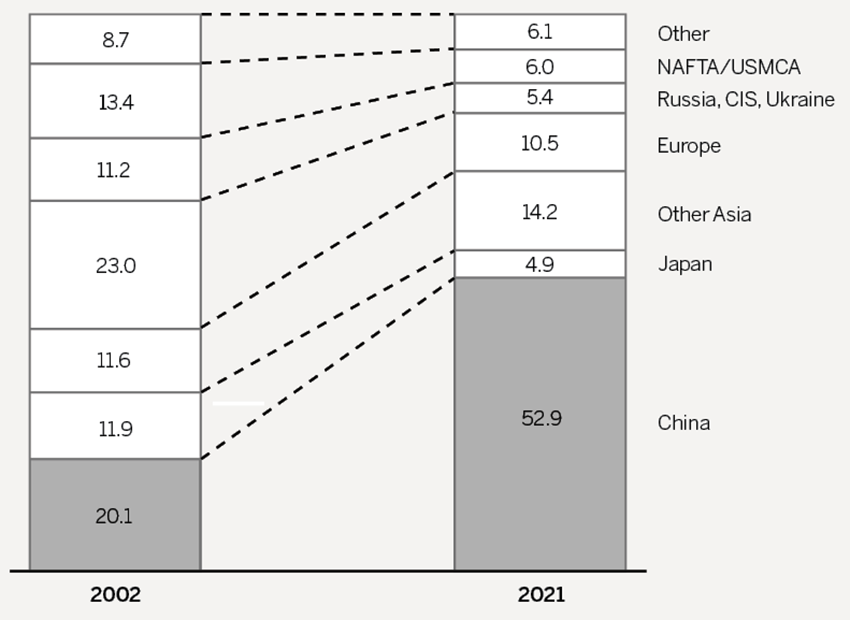

Today, China manufactures almost $5 trillion of goods each year, roughly 30% of the global total. The country also has dominant market share in many critical inputs (Exhibit 3). China produces 56% of global cement, 53% of its steel and 30% of its plastic.

Exhibit 3: Share of Crude Steel Production, Percent

Source: World Steel Association

Massive Manufacturing Clusters

As China’s share of global manufacturing grew, manufacturing clusters formed for distinct industries. Each cluster is composed of interconnected businesses in a geographic region, with each business benefiting from the others’ growth. Clustering provides a host of economic advantages as specialized workforces and institutions develop, providing qualified labor and opportunities for innovation. With everything close at hand, transporting inputs takes little time or money, and communicating inventory or production adjustments is easy.

Many clusters dominate their global industry. The cluster in Danyang County produces 40% of global eyewear, while 90% of the global lighting industry can be traced back to Guangdong Province. Home to some of China’s most innovative cities, like Shenzhen and Guangzhou, Guangdong Province also accounts for one-third of global consumer electronics output.

Clustering isn’t a new concept. Much of the global auto industry, including parts and steel, clustered in or near Detroit beginning at the turn of the 20th century. But China’s clusters are much larger. By mid-century, about 200,000 people were employed by the auto cluster in the Detroit area. Today, the consumer electronics cluster in Shenzhen employs over 2 million people.

Sustainable Advantage

As manufacturing migrated to China and the Chinese economy developed, wages rose rapidly. Cheap labor is no longer China’s advantage. Adjusted for productivity, China’s cost of labor is now higher than Japan’s. Cheap energy is also a less compelling advantage today. Pollution is a major concern for Chinese citizens, and the country has pledged to reach peak CO2 emissions before 2030 and achieve carbon neutrality before 2060.

But the advantages of China’s clusters are hard to beat, anchoring manufacturing there. Moving production to locations with cheaper labor would mean at least temporarily ceding the efficiencies that clustering provides. In many cases, it would also be prohibitively expensive. Relocating production to the U.S. would require not only building new factories that produce those goods, but also new plants to produce the concrete, steel and plastic needed for their manufacture. All this would cost billions of dollars and require decades of concerted effort.

There is little evidence of this happening en masse to date. Perhaps it will over time, but it likely won’t be quick. After all, the Detroit automotive production cluster that developed in the early 20th century and peaked in 1958 remained dominant well into the 1980s, despite U.S. automakers’ loss of global industry share and increased reliance on offshore factories with lower labor costs. Today, the benefits of the region’s specialized production cluster remain visible. Michigan is still the largest exporter of transportation equipment in the U.S., and 96% of the largest automotive suppliers in North America have a presence in the state. Sixty of them are headquartered there.

Supply Chains Will Continue to Evolve

Corporate leaders have told us they’re not moving production away from their current Chinese factories any time soon, citing their economic efficiency and the high cost of relocation. But some have said they’re not building more plants in China. Production growth will occur elsewhere. The massive scale that makes clusters efficient also creates vulnerability to epidemics, natural disasters, and political risk, they note. To western business leaders, many of China’s actions in recent years appear less predictable, adding risk to future investments they may contemplate.

One strategy many firms are pursuing is called “China+1,” where they continue to manufacture or source goods in China, while building additional capacity elsewhere. But until Chinese clusters can be replicated elsewhere, their new factories will likely have to source critical components from suppliers located in China.

Managers must continually weigh a host of factors that differ by industry and company, and that change through time. Two consumer giants, Nike and Apple, illustrate the complexity of building resilient, cost-effective supply chains and their natural evolution over time.

NIKE: Chasing Low Wages

Nike was founded in Eugene, Oregon, in January 1964. With labor a significant portion of production cost for footwear, Nike started locating manufacturing in Japan the same year to take advantage of the low cost of labor in the still war-ravaged nation. As the Japanese economy rebounded in the 1970s, wages there rose, leading Nike to move manufacturing to South Korea and Taiwan. Rising wages in those countries eventually spurred Nike to seek yet another manufacturing base. In 1981, Nike opened its first factory in China. It continued to grow its manufacturing presence there throughout the 1990s. Inevitably, wages in China also began to rise, so in 1996 Nike opened its first factory in Vietnam. By 2012, Nike’s sneaker production in Vietnam equaled its production in China, with 30% in each country. By 2017, Nike’s sneaker production in Vietnam outstripped its Chinese production, 44% to 19%.

While lower wages prompted greater production in Vietnam than China, it seems that Nike cannot entirely quit China. Nike still maintains 104 factories with 123,000 employees in China, versus 114 factories with 537,000 employees in Vietnam. It gets about 30% of its materials from China, versus 23% from Vietnam. Of course, China is a significantly larger end market for Nike than Vietnam: In 2017, Nike sold 17% of its global sneaker output in China. But revenue is clearly not Nike’s main consideration when deciding where to locate production. While one-third of Nike revenues come from the U.S., only 6% of Nike’s factories and fewer than 5,000 employees are in the U.S., and none of its materials originate in its “home country.”

APPLE: Leaning on Clustering

Manufacturing electronics is more complicated than manufacturing shoes and clothes. The benefits of clustering are also greater, due to the larger number of components involved. Apple’s iPhone 12 has more than 178 components, made by a vast network of suppliers. For example, Sony makes the camera sensors, Bosch the accelerometers, and Corning the glass screens. All three have factories in China, as well as other countries, including their home countries of Japan, Germany and the U.S., respectively.

But regardless of where their components come from, all iPhone 12s are assembled in China, by Foxconn, Apple’s largest partner. Foxconn has more than 350,000 people at its assembly site in Zhengzhou, which can churn out more than half a million iPhones a day.

Since Apple and Foxconn established their presence in Zhengzhou, the region has become the world’s largest production center for mobile phones, with suppliers and adjacent businesses in the suburbs. Zhengzhou is now referred to as “iPhone City” by locals. The clustering of suppliers around the factory allows Apple to quickly make adjustments if volumes or specifications change. Despite the rising cost of labor in China, the cluster makes China essential to Apple’s supply chain. Since launching the first iPhone in 2007 from a Foxconn assembly site in China, every Apple product has been assembled in China initially.

Apple has diversified production to other countries after initial launch. One year after launching its cheapest model, the iPhone SE, in China in 2016, Apple announced that a partner would produce the phone in India, with the goal of capturing share in that country’s 1.4 billion-strong domestic market. However, Apple’s Indian factory remains highly reliant on China for critical iPhone components.

The National Security Issue

National security is another frequently cited reason to bring production home for critical products (such as medical masks) and technologies (such as advanced semiconductors). But such endeavors are complicated and costly. The U.S. recently cited national security concerns to justify $280 billion in economic support for domestic production of semiconductors in the CHIPS and Science Act, passed in August 2022. It would take scores of large-scale initiatives like this to alter the landscape of global trade. We are unlikely to see these. Deficit and debt levels are already high in many countries, and governments face a wide array of demands for funds from disparate sources, including military spending, climate change initiatives, and support for aging populations.

Conclusion

The headlines predicting a sharp decline in globalized production are wrong, for many reasons. They don’t capture the many, intricate factors that global firms weigh when determining where to locate production or source supplies. While the disruptions caused by Covid and the war in Ukraine have taught companies that resilient supply chains are important, resiliency doesn’t necessarily mean bringing production home.

Except in a small number of industries designated as crucial for national security—such as batteries and semiconductors—there is little evidence that companies are moving production back to the U.S. or other highly developed markets. The costs of production in many instances are significantly higher, and access to commodities and other inputs can be scarce. Instead, resiliency concerns may simply cause companies to hold more inventory and build slack into “Just in Time” production models.

They will also diversify their sources of production and supply, in various ways. Some global firms may decide to invest more in countries close to large markets. If so, Mexico would likely benefit from its proximity to the U.S., and Morocco and Turkey from their proximity to Europe. Other global firms may move production from China to countries with very low wages, such as Vietnam, India, Indonesia, and Bangladesh, which are already gaining share in apparel and other industries. Overall, firms will generally favor countries with more reliable infrastructure and more stable political, economic and legal systems.

While firms may seek new manufacturing locations, China is likely to remain pivotal to the global economy for the foreseeable future because it would take massive investment and many years to replicate China’s efficient production, complex industrial clusters and unparalleled infrastructure. Access to China’s vast population and economy is also an important consideration for many.

There are two potential developments that could make us change our minds:

-

- A rapid increase in non-automotive sector industrial automation

Automation technology has materially improved over the past decade and costs of implementation have declined. But, until very recently, most management teams have not fully embraced this new technology. Recent labor shortages and healthy corporate balance sheets may eventually lead to more widespread adoption of automated solutions and spur a substitution of capital for labor. If this happens, the calculus regarding where to locate manufacturing facilities would change, and developed markets could be advantaged. This is a focus of ongoing research at our firm.

-

- Greatly intensified geopolitical tension with China

In recent years, China has adopted a more aggressive posture with other governments, while remaining quite accommodating to global firms. If China becomes more aggressive or unpredictable, either on the world stage or domestically, some nations may decide it’s in their national interest to require production of basic goods such as steel at home or in friendly countries. If China becomes less accommodative or predictable for companies, relocations will likely speed up, even if governments don’t require it.

Since the end of World War II, firms have found efficiencies in locating manufacturing where it’s most cost effective. Barring massive change in national policy viewed as permanent, or a huge breakthrough in automation, few companies are likely to abruptly change where they locate production. Instead, most companies will continue to optimize production over time. Even if all the stars align, it will likely take decades to complete major shifts in industrial hubs, just like it took decades to build China’s dominant position.

Supply chains will evolve as political winds continue to shift and the cost of labor and energy fluctuate. In the near term, global production is unlikely to return to the extreme efficiencies of the pre-Covid period. The quest for resiliency will boost the cost of production, likely resulting in higher prices for consumers and margin pressure for global firms. Nonetheless, production is unlikely to just “come home.”